Jan 22, 2026

User Story: How Barebone’s AI Investment App Achieved 77% Returns in 2025 with Linkup

Read about how Barebone’s integration of linkup powers their AI Investment App and led to 77% fund returns in 2025

The Linkup Team

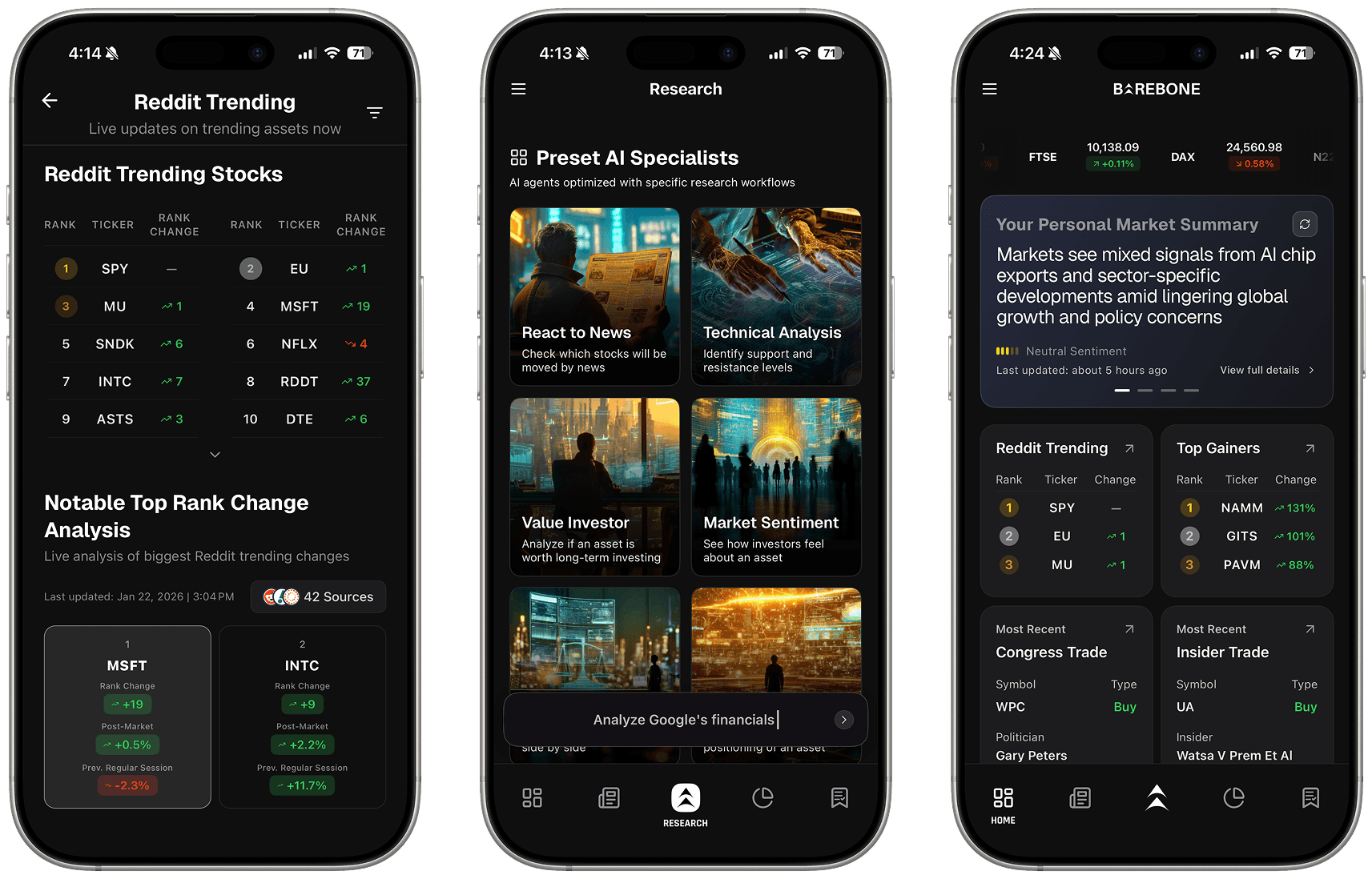

Barebone is a mobile-first investment AI agent that focuses on one thing: detecting emerging, viral narratives early on social media, and turning that into actionable investment research.

As their algorithm matures, not only did Barebone observe significant increases in app downloads and retention, its internal fund posted exceptional returns of +77% over 2025, 4.7x the performance of the S&P 500 and more than 2x the performance of leading hedge funds.

Linkup provides the real-time information layer that makes it possible.

Available on iOS and Google Play, Barebone aggregates and contextualizes what investors are actively discussing across social channels, communities, and news flows, then equips AI agents with this signal layer alongside institutional-grade financial data to help users understand what is gaining momentum and why.

By identifying social and narrative signals before they reach traditional media or research, Barebone consistently surfaces market-moving opportunities ahead of consensus. Examples include emerging tech themes like high-bandwidth memory weeks ahead of mainstream coverage to viral consumer moments like Sydney Sweeney’s American Eagle campaign

In financial AI, accuracy is the baseline requirement. A single hallucinated figure or a misquoted news event can lead to poor trading decisions and actual financial loss. For Barebone, the challenge was finding a search infrastructure that could keep up with the market while remaining precise and accuate.

The Problem: Training Data Gaps and API Flaws

Barebone’s agents need live market data that static LLMs simply don't have. Because financial markets are defined by what is happening right now—earnings calls, regulatory filings, and breaking news—relying on an LLM’s internal knowledge isn't an option.

However, simply adding a web search API didn't solve the problem initially. In their testing of other popular search tools, Barebone hit several roadblocks:

Data Accuracy: Search tools would often return fabricated or misattributed data points, meaning the agents were still hallucinating despite having web access.

Speed and Bottlenecks: Slow streaming disrupted the user experience, and the APIs often struggled to handle multiple parallel searches at once.

Inconsistency: Results were often unstable, making it difficult to rely on the tool for automated, high-scale research.

"We were struggling with hallucinations, slow streaming, and unstable results from other tools. Research quality and speed were both bottlenecks, especially when running parallel searches at scale." — The Barebone Team

Why Barebone Chose Linkup

After relying on Perplexity and testing other alternatives like Exa the Barebone team moved to Linkup after seeing a clear difference in three areas:

High Precision: The search results were significantly more accurate, which is critical for financial applications.

Reliable Scaling: The API handled parallel requests quickly, allowing Barebone to speed up their research workflows.

Direct Support: The level of hands-on support — notably from the founders themselves —provided a level of partnership they hadn't found with other providers

How the Integration Works

Linkup is integrated across multiple layers of Barebone’s platform.

First, while Barebone operates its own proprietary systems for large-scale data collection and aggregation, Linkup is used in the backend to complement and validate external information sources, improving coverage and reliability.

Second, Linkup is embedded directly into the AI agents’ tool calls. When an agent encounters a question that requires live or long-tail information not covered by existing paid data feeds, it triggers a real-time search via Linkup. This allows agents to reason with fresh information instead of stale assumptions.

Third, Linkup plays a role in user-facing features. Barebone allows users to integrate their portfolio, watchlist, and personal preferences into the app. This enables highly tailored research experiences, including daily morning briefs customized for each investor. Linkup is used selectively within these workflows to enrich searches and ensure relevance at the individual user level.

Under the hood, the flow looks like this:

Query Translation: Barebone’s system converts complex investment logic into structured search requests.

Real-Time Retrieval: These queries run through Linkup to pull the latest web intelligence.

Internal Analysis: Barebone takes that raw data and runs it through their own analysis layer, combining it with institutional financial feeds and proprietary signals.

This system supports both Barebone’s consumer app and their own internal fund operations.

The Results: 77% Fund Returns and Increased App Retention

Since integrating Linkup, Barebone has seen a measurable impact on both their internal performance and their user metrics:

77% Annual Returns: Barebone’s internal fund, powered by these AI agents, is up 77% over the last year.

Double the Efficiency: API stability has effectively doubled both the speed and the quality of their research output.

User Trust: By eliminating the worry of hallucinations, Barebone has seen higher user retention and more frequent engagement within their app.

Clear Architecture: Responsibilities are clearly split. Linkup handles real-time information retrieval, while Barebone focuses on analysis and decision support.

"The biggest win is trust. We no longer worry about hallucinations, which significantly improves the end-to-end research experience for users." — The Barebone Team

About Barebone Barebone.ai provides professional-grade investment research through AI agents. It specializes in helping investors spot viral market narratives early and translate into investment opportunities. You can learn more at barebone.ai or download the app on the App Store and Google Play.